What counts as income for a mortgage loan?

What income is considered when applying for a mortgage?

Home buyers often have multiple income streams. Some have two part-time jobs, a full-time job, and a side hustle, contract work, gig work, or income from investment accounts. Others bring in cash from bonuses, commissions, or government-issued benefits.

Fortunately, mortgage lenders are happy to accept most income sources on your loan application, helping boost your qualifying income and your home-buying budget. But each income source will need to be verifiable and steady to qualify. Here’s what you should know before you apply.

Types of income that count towards a mortgage loan

There’s no definitive list of the income streams that qualify for a home loan. Each mortgage lender and loan program has its own requirements — including the types of income that qualify and the length of time you must have earned that income to be able to use it. Keep in mind that lenders are required by law to “make a reasonable, good faith determination of a consumer’s ability to repay” the mortgage loan.

To give you a good idea of the types of income that can commonly be used on a mortgage, we looked at Fannie Mae’s rulebook. Fannie Mae sets guidelines for conforming mortgages, which are the most popular type of home loan. So these requirements will apply to many home buyers.

Eligible income sources for a mortgage loan

- Employee wages and salary income: Full-time employment is the most common type of income for home buyers. Expect to use documentation like recent pay stubs and one to two years of income tax returns to verify

- Self-employed, freelance, and gig work income: Income in exchange for services that are outside of a traditional employment scenario. Anticipate needing at least two years of documentable history and tax returns

- Part-time income: Similar to the requirements for full-time employment, but often two years of income history are needed

- Tips: You’ll need to account for tip income with two years worth of documentation from either W2s or Form 4137

- Bonuses and commissions: Your lender will likely use your average bonus or commission income over the last two years

- Interest and dividend income: While generally eligible, there are some restrictions for investment income received for six months or less

- Retirement, government, and pension income: Income from IRAs, 401K plans, pensions, and other retirement accounts are typically allowed

- Social Security income: Lenders will often allow monthly payments to adults and children with low income or disabilities, as well as older adults age 65 and over

- Disability payments: Unless benefits expire in the next three years, disability income is almost always eligible

- Leave payments: Employer payments for paternity and maternity leave are usually permitted with a letter of explanation that details plan to return to work

- Foster care payments: Usually allowed, but there are some documentation hurdles. Ask your lender about its requirements

- Alimony and child support: These types of payments can often be included when they are regular and can be anticipated for three or more years to come

- Trust income: Usually allowed when the applicant can show that payments will continue for several years after closing

- Unemployment benefits: Although not typically eligible, seasonal workers who regularly claim benefits between seasons may be permitted

- Rental or investment income: In some cases, proceeds from real estate investment property can be used with specialty lenders or some loan programs, like HomeReady

- VA benefits: Similar to trust income, VA benefits are generally allowed provided that applicants can prove benefits will continue for the next several years

- Military income: Allowances for housing and food, while either on base or deployed, can often be included as income

“In short, all income that is verifiable on your taxes”

Self-employment income

Self-employed mortgage borrowers typically need a two-year track record of successful earnings to apply for a mortgage. Lenders average the income if it’s going up, and take the lower figure (or worse) if it’s going down. You’ll also only be able to count your taxable income (after deductions), with a few exceptions for depreciation, depletion, and expenses that won’t recur.

Plan on providing your tax returns if you’re self-employed. And probably your latest financial statements and business license.

Bonuses and commissions

Generally, both bonuses and sales commissions can be taken into account by lenders. They typically consider bonus and commission income earned over the last two years. Lenders look at this income conservatively — if numbers are going up, they’ll average the income. If they are going down, however, the lender may use the lower figure. And if the industry you’re in is failing, lenders may discount income even more.

Part-time jobs

To count the income from an extra or part-time job, you’ll have to have been at it for at least one to two years. This also goes for seasonal work. For example, teaching skiing in the winter and golf in the summer would count if there’s a two-year history.

If you have a part-time job and a full-time job, you’re lender will likely want to see that you’ve worked both simultaneously for a year or two before applying. That’s because working two jobs can be strenuous, and lenders want to be certain you can manage the workload — and keep earning the extra income — consistently for years to come.

Tips

Your tips will be applicable to your lender’s income calculations as long as you’ve been getting them for two years. And you’ll have to back up your claims with documentation, including your last two IRS W-2 forms if your employer reports allocated tips, or Form 4137 if you report them yourself.

Investment Income

You should be able to count investment income — including interest and dividends — in full on your mortgage application However, the amount you can use as income for mortgage purposes will be an average of your last two years’ receipts. If you plan to liquidate any of those assets for your down payment or closing costs, you can expect your lender to deduct their income.

Retirement, government, annuity, and pension income

If your retirement includes savings in an IRA, 401(k), or other retirement accounts, you can use it as income to qualify for a mortgage.

Underwriters start with 70% of your retirement balances to account for fluctuations in the values of stocks and bonds (cash deposits are not subject to this). They then divide your total by the number of months in your mortgage. So if you take a 30-year loan, they divide by 360. If you want a 15-year loan, they divide by 180. That number is your income for the month from what lenders call “asset depletion.”

Social Security income

If you’re getting Social Security income from the government, including retirement or long-term disability benefits, it should normally be accepted as income for mortgage purposes. It’s a bit more complicated when you’re receiving benefits on behalf of a family member. Then, you’ll have to show the income will continue for at least the next three years.

Maternity and paternity leave

Provided you write to your lender, confirming that you will return to work on a particular date, you’ll typically be fine. Your normal employment income will usually continue to apply, even if you’re on a reduced salary or will be unpaid at closing. However, you’ll need a pile of paperwork, including correspondence from your employer confirming your return-to-work date.

Disability benefits

If you receive disability income, it can typically be used on your mortgage application. Long-term disability benefits from sources other than the Social Security Administration almost always count. Short-term disability benefits may also count, depending on how close their expiration date is. If you’re going to transition from short-term to long-term within the next three years, expect only the long-term benefits to be included in your lender’s calculations.

Foster care

Fannie Mae likes you to have been receiving income from fostering for two years. However, it may accept one year, providing the relevant income is 30% or less of your total gross income.

Alimony and child support

Alimony and child support payments can count as income for a mortgage, but only if the payments are consistent. If your ex-spouse doesn’t make regular alimony or child support payments, you may not be able to count that income. Not even if you have a watertight court order or separation agreement. Because you’ll have to show you’ve received “full, regular and timely” payments going back at least six months.

Also, lenders will look at how long you can expect to receive child support. Suppose your child is 16 years old. And that your child support’s going to end when they’re 18. You can’t count that support toward your income for mortgage purposes, because qualifying income must continue for at least three years. Of course, if you have younger kids who will be supported for three or more years, their child support will still count.

Trust income

If you’re the beneficiary of a trust, that money should be applicable income for mortgage purposes. You’ll have to show that you’ll receive it for at least three years. And the lender will need a copy of the trust documents confirming the frequency, amount, and duration of the payments.

Unemployment benefits

You’re unlikely to get a mortgage on unemployment income because unemployment benefits are intended to be temporary by nature. But unemployment income may count if you’re a seasonal worker who regularly claims those benefits between jobs. Your lender will want to see that you’ve been getting benefits and working in this way for a couple of years. And it will verify that you can reasonably expect the pattern to continue.

VA benefits

VA benefits should normally count for a mortgage. All you have to do is prove you’re getting them and show they’ll last for at least the next three years. You won’t have to provide that verification if you’re receiving your benefits owing to retirement or long-term disabilities.

Rental income

Rent from boarders generally counts as income for mortgage purposes only with some specialty programs, such as Fannie’s HomeReady loan. However, there is an exception. That’s when you have disabilities and your personal assistant lives in and pays you (or maybe Medicare Waiver funds pay you) for their accommodation. Still, you can only count 30% of that rent as income.

“Grossing up” income

Some kinds of income are not subject to taxes. For example, child support and disability. In that case, lenders are allowed to count that income as worth more. Usually, non-taxable income is worth 25% more for mortgage qualifying. So, $1,000 a month in child support counts as $1,250 a month. They call this practice “grossing up” income because you’ll actually have more after-tax income. “This is most often done with retirement income, such as Social Security,” adds Meyer.

Why mortgage companies care about income sources

Many first-time home buyers won’t have to worry much about multiple income sources. Chances are, you have pretty straightforward finances. Indeed, for many, a single income stream from one employer is all they have — and all they need.

But others have multiple streams from different sources. Or one stream made up of different elements. In this case, approval can be a little more complicated. That’s because the lender has to verify each income stream individually to ensure you’ll continue at the same total income level for years to come. Remember that a mortgage lender’s ultimate goal is to make sure you can afford your home loan payments for many years into the future.

Ability to repay

All lenders have a legal obligation to “make a reasonable, good faith determination of a consumer’s ability to repay any consumer credit transaction secured by a dwelling.” In other words, they must examine your finances in detail. Because they must make sure you can comfortably afford your monthly mortgage payments, home equity loan, or home equity line of credit (HELOC).

This is called the “ability to repay” provision. It protects against predatory lending to people who have little chance of repaying their mortgages.

Income rules and rule makers

Mortgage lenders all have the same legal obligation to ensure your ability to repay. But some interpret that duty differently. So if you’re turned down by one lender, it may be worth trying others.

If you want a government-backed home loan, the rules on income for mortgage qualification are written pretty tightly. Those government-backed mortgages include Federal Housing Administration (FHA) loans, Department of Veterans Affairs (VA) loans, and U.S. Department of Agriculture (USDA) loans.

Fannie Mae and Freddie Mac also closely specify the income streams they’re prepared to accept for conventional loans. However, those aren’t chiseled in stone. Conventional mortgages may be more flexible when it comes to income qualifying than government-backed mortgages.

Rules may vary by lender and loan program

In very exceptional circumstances, lenders may bend some income rules for favored borrowers. For example, suppose you’ve been with a local institution for decades. If it knows you have an unblemished payment record and a stellar credit score, it may be willing to bend policy a little.

Equally, Fannie and Freddie write their rules for particular mortgage products. For example, Fannie usually excludes rental income from a mortgage application. But it makes an exception for its HomeReady mortgage. If you apply for one of those, Fannie can count all the income you receive from boarders and renters, provided they’ve lived with you for at least a year prior to buying the home.

What counts as income for a mortgage refinance loan?

If you’re a homeowner looking to refinance your current mortgage, you face the same income requirements as home buyers. You can use a wide variety of income sources to qualify but you must show a steady history of receiving that income. And lenders must be able to ensure it will continue in the future. You will have to prove any income sources using tax forms, bank and investment account statements, pay stubs, and other standard documentation.

Other factors that matter when qualifying for a mortgage

You’ll need more than qualifying income to get approved for a mortgage application. Lenders look at a variety of factors. These include:

- Debt-to-income ratio (DTI): Lenders use your DTI ratio to compare your total monthly debt to your gross monthly income. This shows the economic burden on your household finances. Debt can include payments on car loans, student loans, and credit card payments, to name a few. The lower your DTI ratio, the better your chances of mortgage approval

- Credit score: You’ll generally need a credit score of 620 or higher to qualify for a conventional loan, but some first-time home buyers can qualify for an FHA loan with scores as low as 580

- Down payment: Most borrowers will need at least 3% down for conventional mortgages and 3.5% down for FHA loans. Keep in mind that you’ll pay private mortgage insurance (PMI) without 20% down on a conventional loan. And mortgage insurance premiums (MIP) is required on an FHA loan, regardless of the down payment amount. Both USDA and VA loans require no down payment whatsoever

- Asset and cash reserves: Many lenders and loan programs want buyers to have adequate cash reserves or emergency funds after closing on a new home. This shows that you’ll be able to make your monthly mortgage payments in the event that your income ceases

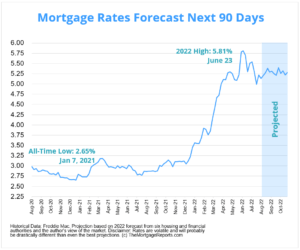

Today’s mortgage rates

The above examples are a broad overview of what can count as income for mortgage purposes. There’s a whole lot more detail, so talk to your lender about what rules apply.

Remember that there is a legal obligation on lenders to ensure your home loan will be affordable. They’re going to vet every income source thoroughly. So begin getting together your paperwork early.

In the meantime, you can review your current home-buying options using the link below. It’s free to compare interest rates from multiple lenders, and you are under no obligation to act.