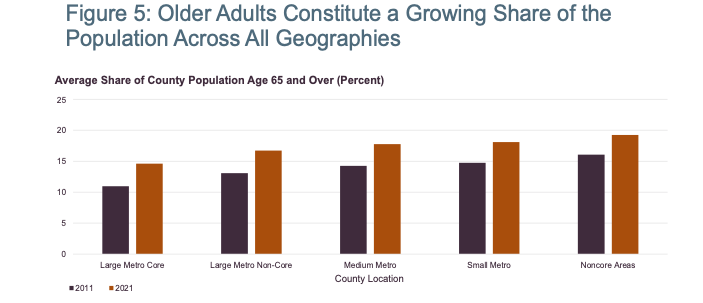

The US population 65 and over soared by 34 percent in the last decade, from 43 million in 2012 to 58 million in 2022. In the coming decade, the fastest growth will occur among those over 80, when people are more likely to need accessible housing as well as services and support at home. The US, however, is not ready to provide housing and care for this surging population, according to our new Housing America’s Older Adults 2023 report.

The Dual Challenge of Housing and Services in Later Life

Older adults, whose incomes are often fixed or declining, increasingly face the twin challenges of securing affordable housing and the services they need to remain in the home of their choice. In 2021, an all-time high of nearly 11.2 million older adults were cost-burdened, meaning they spent more than 30 percent of their income on housing. Cost burdens are particularly high for renters, homeowners with mortgages, and households age 80 and over. Accessible housing is also in short supply; fewer than 4 percent of US homes offered the three key features of accessible housing—single-floor living, no-step entries, and wide hallways and doorways—at last measure.

The Cost of Long-Term Care Is Out of Reach for Most Older Adults

The costs of long-term care (LTC) services are also high, averaging over $100 per day nationwide. The majority of older adults will need these services and those with very low incomes, who are most likely to require them, have the fewest resources to pay for them. When LTC services are added to housing costs, only 14 percent of single people 75 and over can afford a daily visit from a paid caregiver, and just 13 percent can afford to move to assisted living.

Government Assistance Is Insufficient to Meet the Growing Need

Government-funded rental assistance provides crucial support to older adults with very low incomes, but demand dramatically outstrips supply, and with homelessness on the rise among this population, assistance is more important than ever. Those with slightly higher incomes also struggle to qualify for assistance; 29 percent of people living alone who are 75 and over have incomes above 50 percent of area median income, but cannot afford the cost of assisted living. Just 8 percent of this group could afford a daily visit from a home health aide.

Renters and Homeowners of Color Face Steeper Burdens

While some older adults have home equity that can be tapped to pay for care or services, many do not. This is not only because of the increasing number of older adults but because of widening wealth and income inequality. Older renters have only 2 percent of the net wealth of older homeowners and there are steep inequalities among owners as well; older Black homeowners have the lowest housing equity at $123,000, compared to $251,000 for older white homeowners, $200,000 for older Hispanic owners, and $270,000 for older owners who are Asian, multiracial, or another race.

Mortgage Debt Among Older Adults Is Rising

Between 1989 and 2022, the share of homeowners 65 to 79 with a mortgage increased from 24 to 41 percent and the median mortgage debt shot up over 400 percent, from $21,000 in 1989 to $110,000. Over 30 percent of homeowners age 80 and over are also carrying mortgages, up from just three percent three decades ago. Borrowing is often a way for older homeowners to access cash for basic needs or care. Given the importance of housing equity later in life there is a real need for safe and affordable mortgage products that work for older owners with limited incomes. Financing incentives could provide better opportunities for those who wish to remain in their communities but in more suitable homes; this would be particularly welcome in rural and other low-density areas where the choices are especially limited.

The Growing Threat of Climate Change

Some states long favored by older adults because of their warmer weather are increasingly experiencing extreme heat and harsh storms. In addition to health risks, property damage is a rising concern, particularly for the increasing number of older people without insurance. Severe storms in Florida caused $228 billion in property damage from February 2020 through April 2023, a state that is home to 8.3 percent of the nation’s older population.

The Outlook

As the US population ages, more older adults will struggle to afford either the home of their choice or the care they need. With subsidies for housing and LTC services scarce, many older adults will have to forgo needed care or rely on family and friends for assistance. More funding would be needed, but there is a tremendous need for creative alternatives to existing models of care and housing to better support the country’s rapidly aging population.